Lately, we’ve been receiving a lot of questions from tourists: is it possible to get a VAT refund on purchases in Phuket?

Yes, you can — and it’s quite easy.

In this article, we’ll explain the step-by-step process for applying for a VAT refund and what nuances are important to consider.

What is VAT Refund?

VAT Refund (Value Added Tax) is a value-added tax (VAT) refund.

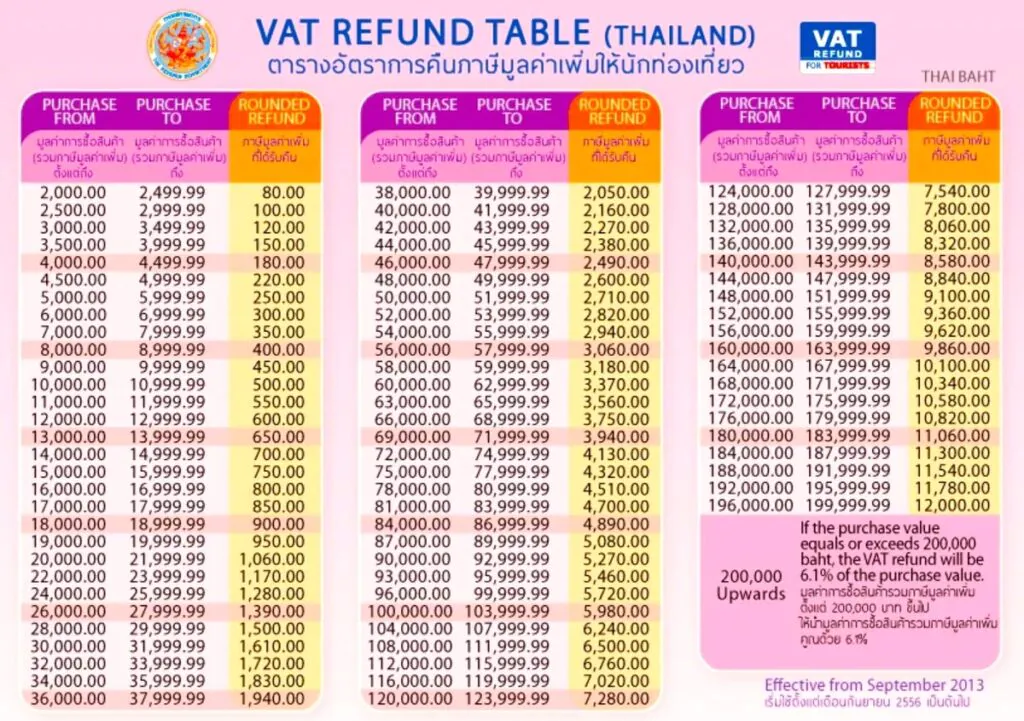

In Thailand, you can get back 4% to 6.1% of the purchase price if the cost of one item exceeds 2,000 baht.

The exact refund amount depends on the price of the item.

There’s a table at the VAT Refund counter at the airport that explains everything.

What items qualify for a VAT Refund?

Not all stores participate in the program.

Before making a purchase, be sure to check with the seller whether they offer VAT Refunds.

The main requirement is that the documents are properly completed.

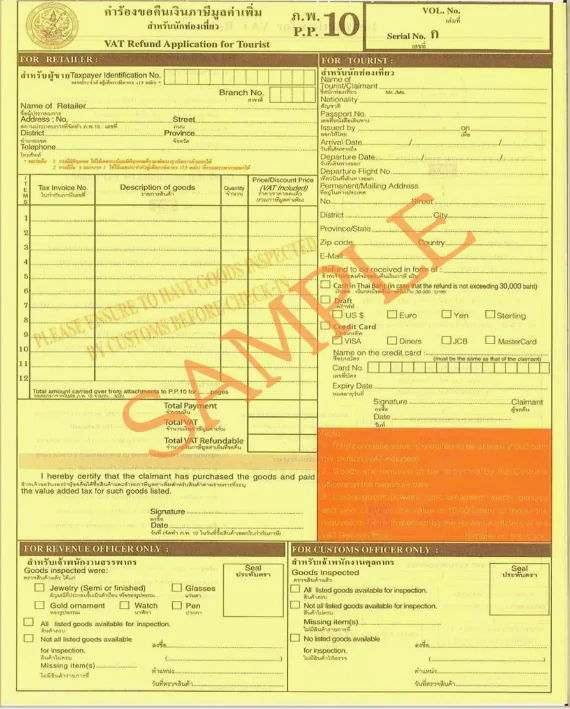

The seller must give you a receipt and a completed P.P.10 form.

You should keep these documents until your departure.

Stores participating in the program are easily identified by the «VAT Refund for Tourists» sign.

This sticker is usually located at the entrance.

Who can get a VAT refund?

Only tourists arriving in Thailand on a tourist visa or stamp are eligible for a VAT refund.

If you are in the country on a work, student, or business visa, you are not eligible for a refund.

Where can I get a VAT refund?

Refunds are only available at international airports.

If you cross the border by land, you cannot get a tax refund.

It’s also important to remember:

Receipts and forms are valid for 60 days from the date of purchase.

Don’t wait until the last day to apply.

Procedure at the airport

Step 1

- Upon arrival at Phuket International Airport, proceed to Block F and look for the sign «Customs Inspection for VAT Refund.»

- Here you will need to present your passport, receipts, Form P.P.10, and, if necessary, the purchases themselves.

- After inspection, you can proceed to passport control.

Step 2

- After passport control, turn left and walk to the end of the hall – there’s a VAT refund counter.

- Show your documents and receive your refund in cash.

What is important to know

Firstly, purchases worth up to 20,000 baht are generally not inspected.

However, customs has the right to conduct random checks.

Secondly, luxury items — smartphones, laptops, jewelry, watches, bags, gold, and other items — worth over 40,000 baht must remain in your possession after checking your baggage.

If you have non-luxury items in your carry-on baggage with a total value exceeding 100,000 baht, you must also keep them with you until departure.

Briefly about the main thing

- Make purchases at stores marked «VAT Refund for Tourists»

- Minimum purchase amount: 2,000 baht

- Complete and keep your P.P.10 form and receipt

- Arrive at the airport early

- Get your stamp at the Customs Inspection counter

- Collect your money at the VAT Refund Office

Getting a VAT refund at Phuket Airport is simple and rewarding if you know the rules.

Follow these steps, and you’ll be able to get some cash back on your purchases before your flight home.

Have a nice flight and happy shopping!