Surely, every traveler who’s used to keeping track of their money is wondering: can they get a refund on purchases in Thailand? The answer is yes! And it’s easy.

Today, we’ll look at how to get a value-added tax (VAT) refund before departing Phuket, which purchases are eligible for a refund, and what nuances are important to consider.

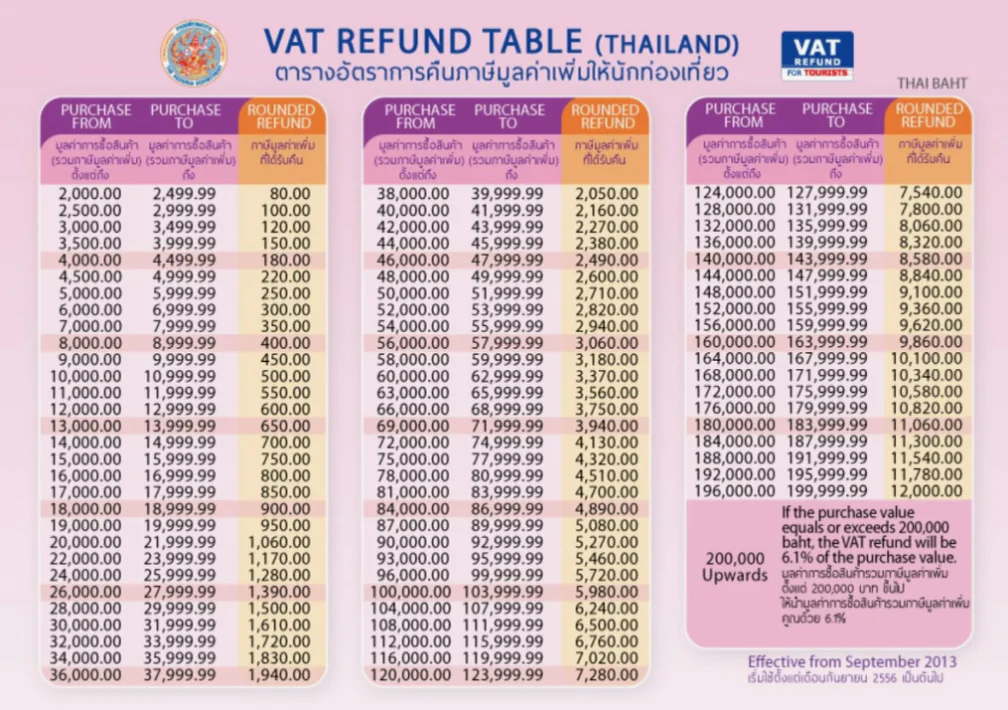

It’s important to note right away: refunds are only available for items priced at 2,000 baht (approx. $60 USD) – anything less, unfortunately, is not eligible.

What is a VAT Refund and how to get a tax refund in Phuket?

VAT Refund (Value Added Tax) is a refund of value-added tax on purchases made by tourists abroad. Each country has its own rules and refund percentages, but we’re, of course, talking about Thailand — and Phuket in particular.

Prices for clothing, electronics, and accessories are already lower here than in Europe or the US, and the opportunity to get up to 7% back on purchases makes shopping even more enjoyable. It’s a great savings, especially when it comes to designer clothing, jewelry, gadgets, or cosmetics.

For the 2025/2026 season, major shopping malls and well-known brands — Uniqlo, Zara, H&M, and others — have officially joined the VAT refund system. The goal is simple: to make Thailand even more attractive to travelers.

Shopping centers in Phuket where you can apply for a VAT Refund:

- King Power

- Jungceylon Shopping Center

- Central Festival

- Premium Outlet

- Central Phuket

Who can get a VAT refund on purchases in Thailand?

Only tourists, i.e. persons who are not residents of Thailand, are eligible for a tax refund.

Unable to apply for a VAT Refund:

- Citizens permanently residing in Thailand;

- Holders of work, student, pension, diplomatic, and other long-term visas;

- Aircraft and sea crew members.

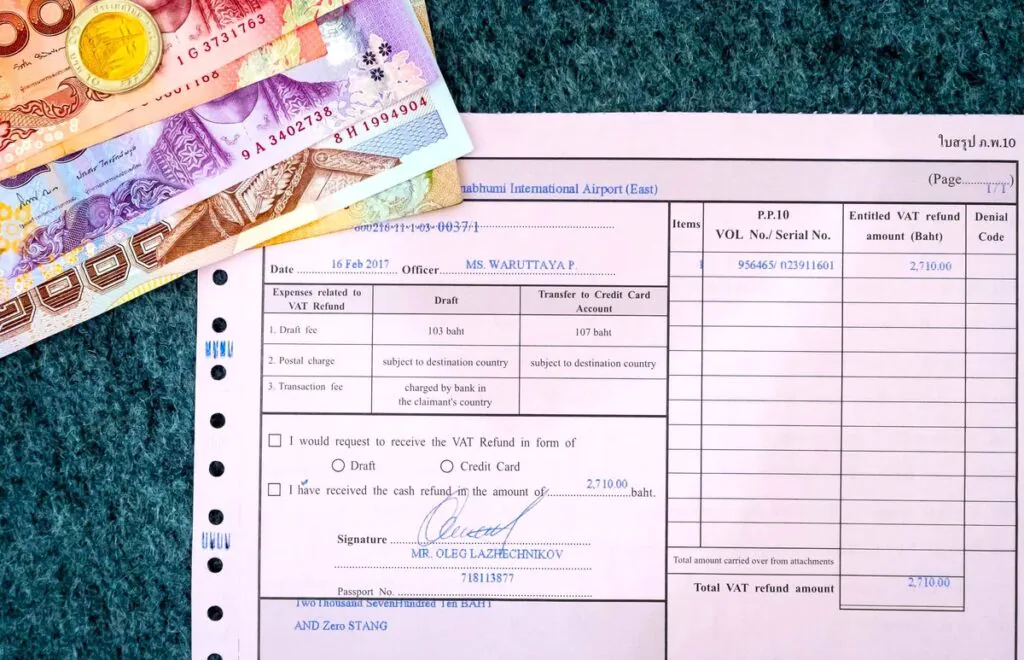

Be sure to save the completed form P.P.10 — you’ll receive it at the store along with your receipt. The form must include your passport information, purchase date, product name, and total amount.

Check that it’s filled out correctly and be sure to sign it, otherwise the form will be invalid.

How to apply for and receive a VAT Refund

Arrive at the airport early — the tax refund process takes about an hour, especially if the queue is busy.

Before checking in for your flight, go to the Customs Department counter. Here you will need to present:

- Passport;

- Purchased goods in their original packaging;

- Receipts;

- P.P.10 forms completed by the seller upon purchase.

The inspector must certify the documents with a seal — without it, a return is impossible.

After passport control, head to the VAT Refund Office. At Phuket Airport, it’s located on the third floor of the International Terminal. Show the officer your passport, boarding pass, certified forms, and receipts.

You can receive money via:

- Cash (up to $700);

- Bank check;

- Transfer to a card (approximately one month).

Please note: when withdrawing cash, a commission of approximately 100 baht is charged.

Items valued over 10,000 baht may be sealed and can be unpacked at home.

If the purchase exceeds 40,000 baht, items (such as a laptop, smartphone, or jewelry) must be kept with you after checking your baggage.

Briefly about the procedure:

- Make sure the store participates in the VAT Refund for Tourists program (look for the corresponding sticker).

- Make a purchase of at least 2,000 baht and a total of at least 5,000 baht.

- Get your receipt and P.P.10 form from the store.

- Don’t put your purchase in your luggage — you may be asked to show it.

- At the airport, get the form stamped by customs.

- Claim your refund at the VAT Refund for Tourists office.